Professional

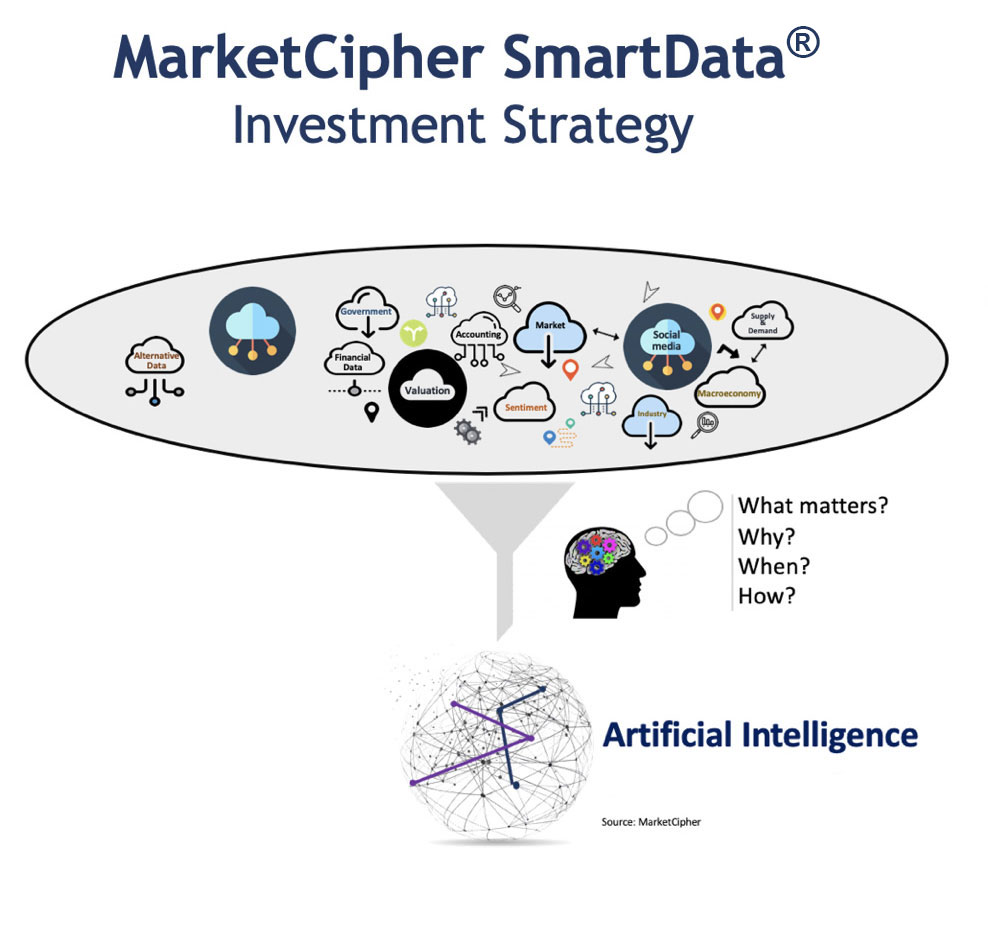

MarketCipher SmartData® Investment Strategy

MarketCipher’s SmartData® Investment strategy aims to deliver positive risk-adjusted regardless of the investing regime, by integrating property human insights (MarketCipher SmartData®) with advanced quantitative techniques including artificial intelligence. The strategy is instituted by trading futures and options on futures.

MarketCipher SmartData®

Our MarketCipher SmartData® are human insights derived from years of research that are then ingested by artificial intelligence for weighting and optimization purposes.

Characteristics of our MarketCipher SmartData®:

- Relevant – based on causality not correlation

- Sustainable

- Specific to each asset and time horizon

- Comprehensive

- Identifies both trends and regime shifts

- Explainable

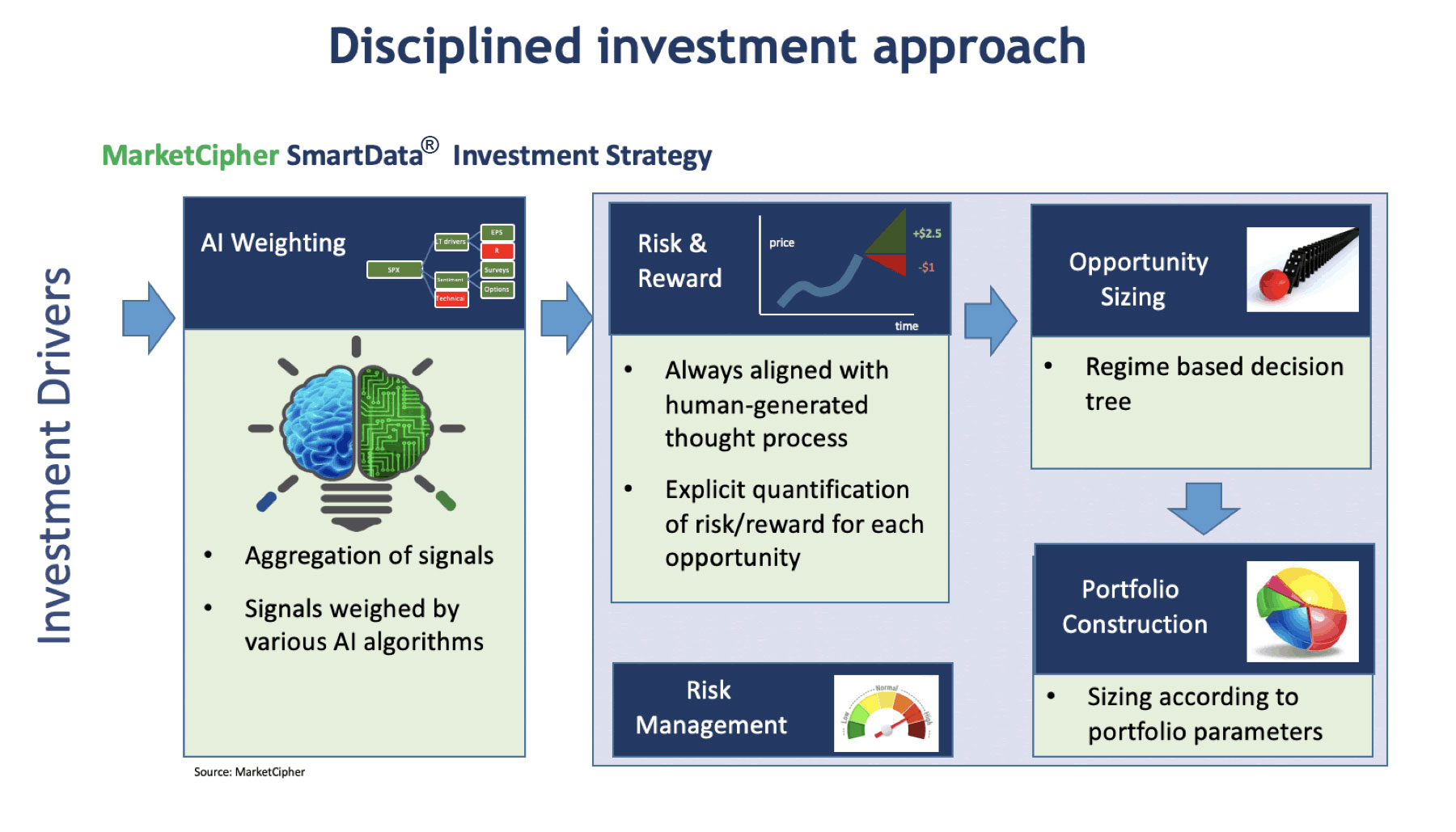

Investment Process

Whereas industry trends are toward employing “Big Data”, MarketCipher has developed unique intellectual property that feeds our MarketCipher SmartData® into artificial intelligence with the goal of optimal decision making.

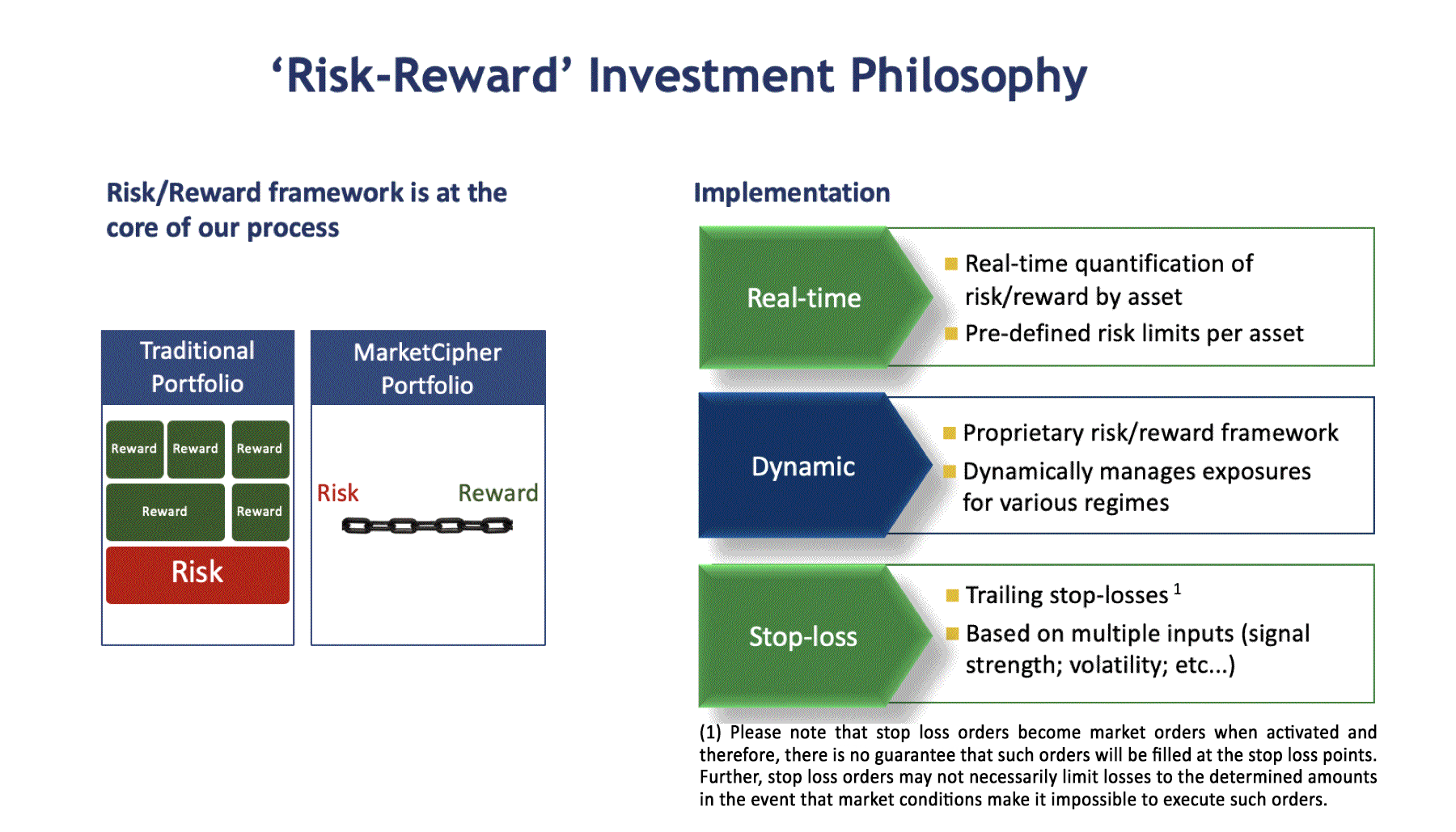

Risk-Reward Investment Philosophy

MarketCipher has a disciplined and comprehensive risk management system called “MarketCipher Cover 5”.

This unique multi-layer risk management system is applied across each individual asset class.

MarketCipher

Cover 5

- Risk-reward quantification based on MarketCipher SmartData®

- Options for downside protection at times.

- Low margin-to-equity

- Discretion for risk reduction

- Stop losses as our last line of defense. (1)